Workers’ compensation insurance is a pivotal aspect of operating a business in Arizona, providing essential protection for both employees and employers. This insurance system is designed to cover medical expenses, rehabilitation costs, and lost wages for employees who suffer work-related injuries or illnesses. For employers, it offers a level of immunity from certain types of lawsuits brought by injured employees. Understanding the nuances of Arizona’s workers’ compensation insurance can help businesses navigate this critical requirement more effectively. Here’s a comprehensive guide to assist you.

Understanding Arizona’s Workers’ Compensation Requirements

In Arizona, most businesses that employ one or more persons, whether on a full-time, part-time, temporary, or seasonal basis, are required to carry workers’ compensation insurance. This includes corporations, sole proprietors, partnerships, and LLCs. The insurance must be maintained continuously, and failure to do so can result in significant penalties, including fines and the possibility of being ordered to cease business operations until compliance is achieved.

Securing Workers’ Compensation Insurance

Workers’ compensation insurance can be obtained through a commercial insurance provider licensed to offer coverage in Arizona. Alternatively, businesses with sufficient financial strength may qualify to self-insure their workers’ compensation liabilities, although this requires approval from the Arizona Department of Insurance and Financial Institutions (DIFI).

Coverage Details

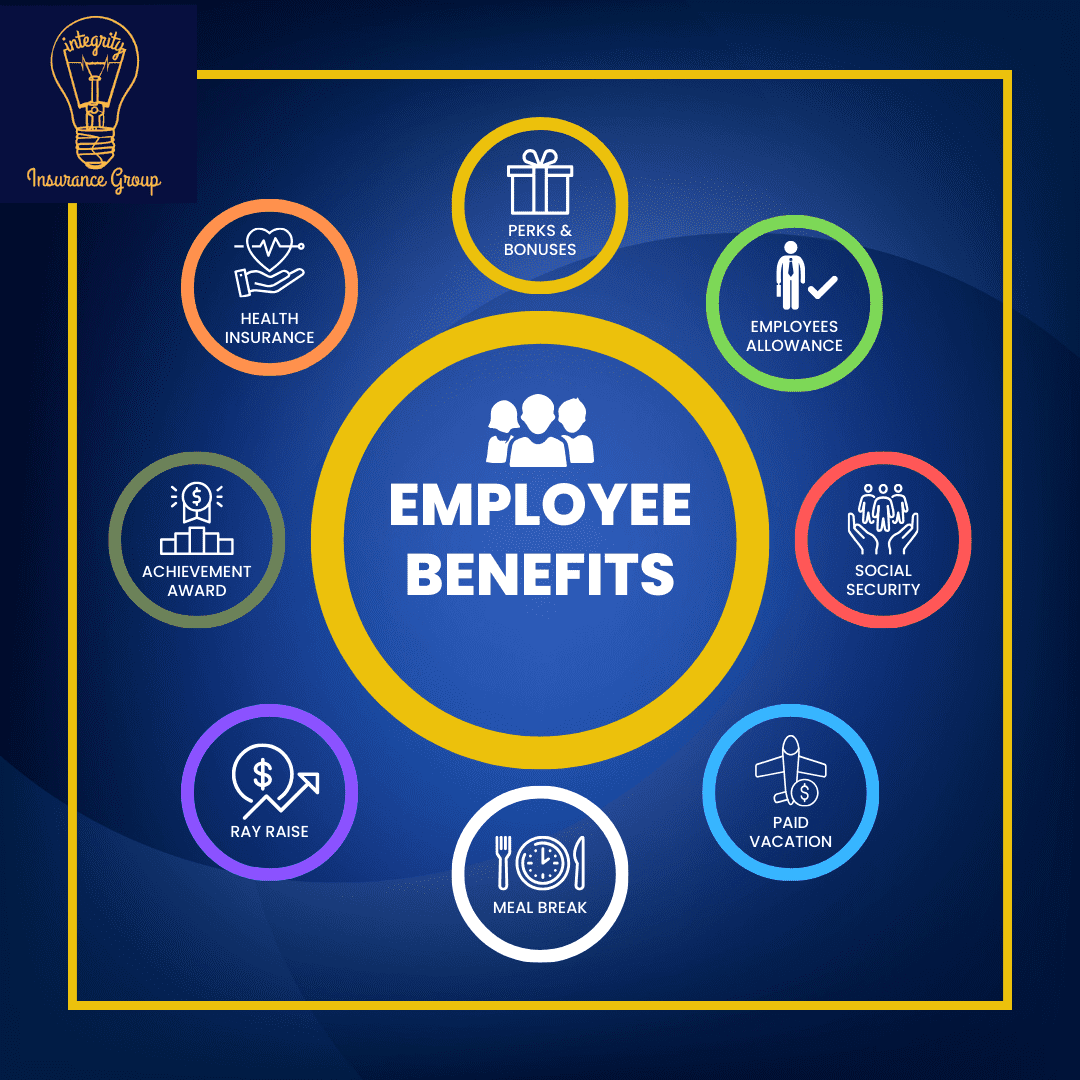

Workers’ compensation insurance in Arizona covers all necessary medical treatment for work-related injuries and illnesses, compensation for lost wages, and benefits to dependents in the case of a work-related death. It’s important to note that coverage is provided on a no-fault basis, meaning employees are entitled to benefits regardless of who was at fault for the injury or illness.

Reporting and Claim Process

Employers must report any workplace injury to their insurance carrier as soon as possible. The injured employee also has a responsibility to inform their employer about the injury promptly. Once a claim is filed, the insurance carrier will evaluate it to determine eligibility for benefits. Employers should maintain open communication with their employees and the insurance carrier throughout the claims process to ensure that any issues are addressed promptly.

Preventing Workplace Injuries

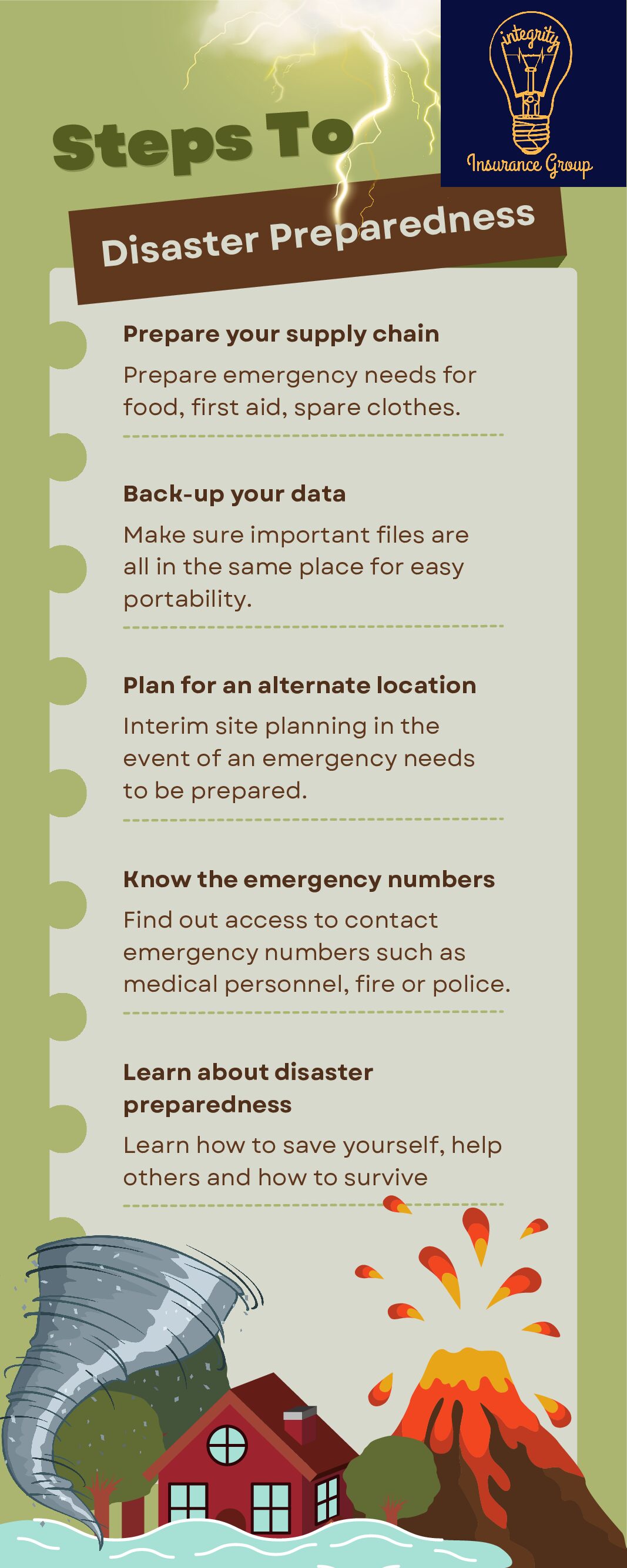

While workers’ compensation insurance provides necessary financial protection after an injury has occurred, the best strategy is to prevent injuries from happening in the first place. Employers should invest in comprehensive safety programs, conduct regular training sessions on safe work practices, and promptly address any workplace hazards.

Managing Workers’ Compensation Costs

The cost of workers’ compensation insurance varies based on factors such as the employer’s industry, claims history, and payroll. Employers can manage and potentially reduce their insurance costs by maintaining a safe work environment, promptly addressing injuries when they occur, and implementing return-to-work programs that help injured employees transition back to work safely and efficiently.

Navigating workers’ compensation insurance in Arizona requires a thorough understanding of the law, diligent safety practices, and effective communication with both employees and insurance carriers. By proactively managing their workers’ compensation responsibilities, Arizona businesses can create a safer workplace, protect their employees, and manage their insurance costs more effectively. Remember, investing in workers’ compensation insurance is not just a legal requirement—it’s a critical component of your business’s risk management strategy.